In a previous SEO post, I talked about how my search mantra is to “Play well with others.” The binding concept is that participating fairly in the greater ecosystem of the internet will bode well for our SEO efforts—not gaming the system or trying to exploit the latest algorithm.

As part of my overall approach, I am going to share an audit we perform called “Online Share of Voice.” We typically perform this audit as part of brand research, but it can be used by anyone trying to get a sense of how your company shows up online.

Let’s dive in.

What Does “Share of Voice” Mean?

In essence, Share of Voice takes an accounting of how you show up online compared to your competitors. The audit looks at a variety of quantitative and qualitative metrics to get a clearer picture of a company’s marketplace positioning online.

At base-bottom, online Share of Voice is important for SEO simply because the larger your online footprint, the more trustworthy and important you appear online, and that provides an SEO lift.

The items we look at for Share of Voice include the following:

- Website metrics, including traffic (visits, uniques, sources), backlinks, site structure, SERPs, and organic search keywords

- Social media content and data

- User experience testing, including desktop and mobile experience

- If applicable, e-commerce integration and third-party marketplace presence

While we take other factors into account as well, like paid media, earned media, and overall brand consistency, the above items are organic, owned assets you can control.

We then compile and distill the findings into a report that weighs the quantitative and qualitative findings in an easy-to-understand scoring system and a small write-up highlighting each competitor’s positives and negatives.

Your Online Competitors May Not Be Your Competitors IRL…Yet.

What do I mean by that? With Share of Voice audits, there is a very good chance you will find you are competing against companies that, today at least, barely register as a blip on your competitive radar. The organic internet is a true democracy in that way. It doesn’t care if you’re a $10B company going against a $10M company for eyeballs. If you aren’t showing up online in a meaningful way, you don’t exist. Period. Participating in a Share of Voice audit can help you uncover these prowling online competitors you may or may not know exist.

What Share of Voice Doesn’t Include

Share of Voice doesn’t include technical SEO factors, except as they relate to a front-end user experience. Share of Voice also doesn’t include things like how an analytics suite is set up. Sure, you may notice those things, but for Share of Voice, it’s important to focus exclusively on the overall online presence. It’s also important to not look at how those well outside your industry are performing, except where you see overlap in organic keywords that may not have been apparent previously.

With all that said, let’s take a closer look at what each Share of Voice audit item looks like.

Performing a Share of Voice Audit

Identify at least three competitors (and potentially more) with which you have an overlap in your target market. It should go without saying, but the more competitors you list, the more complex the analysis becomes, particularly when you are comparing and contrasting the differences in your final synthesis. I don’t recommend checking more than five or six key competitors, although we have performed larger audits than that.

Much of what you find will dictate that you cross-reference and investigate multiple signals in the data to come to a working theory as to why something is happening. For instance, website data can point to successes or failures on social media. A site that gets a lot of traffic but has a high bounce rate could have a user experience problem. High time on site could mean a rapt audience, particularly if the traffic is low as well, but maybe the company has a small social presence and lacks a top-of-funnel marketing approach.

One thing will lead to another until you get a clear picture of what is actually happening across multiple touchpoints. Be curious and stay curious throughout the process. At the end of this audit, it’s going to be the quality of your thinking that gives weight and relevance to the data.

Tools and Techniques

To perform an online Share of Voice audit, we use a mix of tools along with good ol’ fashioned elbow grease and expertise. Our tools typically include SEMRush, Screaming Frog, Builtwith.com, Buzzsumo, manual checks of websites on different devices, manual searches, a trained eye for UX, a spreadsheet program (e.g., Excel or Google Sheets), and a document program (e.g., Word or Google Docs).

Tools we use to assess Share of Voice

Don’t worry if you don’t have all of these tools—you can accomplish a lot just by using free (or trial) versions, researching on your own, being curious, and compiling your findings.

Website Metrics

For website metrics like traffic and organic keywords, you’ll ideally want to use a tool like SEMRush to run reports on competitors. After you’ve run the reports, export them into a spreadsheet and compile the initial findings.

The data will be revealing just on the surface, but there’s a good chance it will uncover interesting factoids for you to dive into. For instance, you may find the following:

- A competitor’s site has a kajillion backlinks, but doesn’t get the organic search traffic you might expect. In that case, they may have a lot of toxic links that are worth researching.

- A site has decent overall traffic, but it’s all coming from search with very little direct traffic. This could indicate very low brand awareness, because no one is navigating directly to the site.

A few questions you may want to explore:

- Who is performing well for competitive keywords? Does it indicate a need to explore other channels to get a sense of a company’s content and distribution strategy?

- Does keyword performance translate to site traffic? Is someone keyword stuffing?

- How many pages does the site have, and does it provide a competitive advantage in any way?

Website metrics will point out some obvious answers, but you will need to connect some dots to begin to make sense of the story.

Search Engine Results—Organic Keywords

Along with site traffic, digging deeper into which keywords are actually driving traffic will be useful. As I mentioned above, while a Share of Voice audit shouldn’t include those outside your industry, you may find you have some competitors online that you underestimated.

How does this happen? Think about it from the point of view of someone who is doing a search on your industry. You may be in enterprise B2B packaging solutions, but for a middle manager who needs a new custom packaging solution, the companies who show up in search results for “custom packaging solutions” may not be who you are competing against regularly.

Identify a set of keywords you would like to rank for, or use a tool like SEMRush to identify keywords and potential overlap. Find keywords you aren’t ranking for that you want or need to be ranking for and see where you end up in SERPs. Also, don’t be afraid to do manual searches on different devices and, if you can, ask others to do some searches as well and send you screenshots of the results.

Social Media Content and Data

There are two different levels to social media analysis:

- Quantitative: Looking at the raw numbers of followers, posts, post engagement, post frequency, and the channels a company has a presence on.

- Qualitative: What kind of content is being posted, the frequency of posting, fan/follower engagement, quality of graphics/video/images, company voice, typos/errors, and general management of the social media channel.

A company’s use of social media is a pretty decent metric that indicates the values and culture of company leadership. Believe it or not, even in 2019, there are plenty of companies who still don’t see business value in social media. You may be working at one of those companies. But, if these companies are still doing well without a social media presence, they’re doing so in spite of their non-usage, not because of it.

For the analysis, you’ll want to plug all the quantitative and qualitative data into a spreadsheet (again) so you can gather it all in one place. Make sure to have a column for “Notes” where you can write down general observations, like how social media channels are used (e.g., LinkedIn is primarily for career and culture, Facebook is used for product information, etc.)

Taken in concert with the website, you will get a clearer picture of each competitor’s content strategy. Observations and general hypotheses can start to be made once you have both the website traffic and social media presence information gathered.

User Experience Testing, Including Desktop and Mobile Experience

Looking at how a brand shows up online includes thinking through what type of experience a company is giving its users. A site’s UX typically ties back to a company’s overall brand positioning and its content strategy, helping build your overall impression of the brand. You may find that some sites are clean and modern, but the brand lacks a social presence. Why might that be? What conclusions could you make? Some basic questions to consider:

- Does the site look modern and new, old and out of date, or somewhere in-between?

- Is the site easy to use? Can you easily find the things you are looking for—product and services information, company information, contact info?

- How do they treat calls to action?

- Does their overall messaging and tone of voice tie into how they treat their social channels?

- If a company has e-commerce on their website, what is the cart checkout process like? Is it easy to find products and complete the sale, or is the experience convoluted and emotionally draining?

- What do online reviews say about the product? The brand? The company?

E-commerce Integration and Third-party Marketplace Presence

E-commerce is important for a variety of reasons beyond the obvious (making money!). Some companies are service-only and have no obvious opportunity for an e-commerce element. Even for those companies, e-commerce integration—even if it’s just selling company swag online—could be an opportunity for growth. The reason is e-commerce lends a site depth and expands keyword footprint, and can drive additional traffic.

For companies with an obvious opportunity for e-commerce, this topic is all the more important in a Share of Voice audit. If a company sells products on a third-party marketplace like Amazon, it expands their footprint greatly. On Amazon, for example, a company can have a store that essentially amounts to an entire secondary website. Some questions to consider here:

- Does the company have product(s) to sell online?

- Do they sell on their own website? What is the shopping experience like? Is it easy to navigate and purchase? Why or why not?

- Do they sell on a third-party marketplace (e.g., Amazon, Walmart, etc.)? How extensive is their presence on these sites?

- Is there anything they could sell online, but don’t?

Synthesis and Findings

Now that you have all this data on your company and its competitors, what do you do with it? First, you want to start looking for patterns and note if there are any companies with a clear advantage or disadvantage online. Next, you’ll want to note your data and observations as to why that is, backed up by evidence—hard data, screenshots, and clear examples. Distill your findings overall into a few simple bullet points as well as the strengths and weaknesses for each competitor.

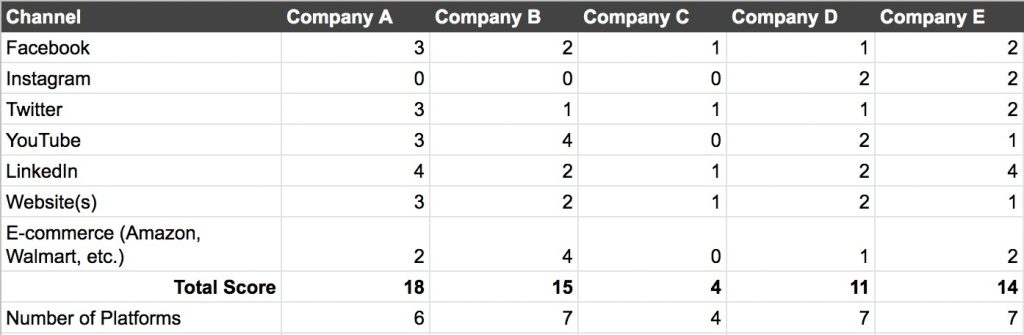

To gain greater clarity from the mass of data, assign a value to each channel and chart it out. This comes in two parts, based on all the data you’ve collected:

- Is a company on a channel?

- How well is that company performing on that channel?

The first question is a simple yes or no. The second question is a little more difficult and requires you to make informed judgments. In order to rank the companies, I think about what the best online brands in the world do, and I weigh that against what a brand in this industry could reasonably achieve given known budgets and scale of operations. I use that model as a baseline for “Excellent” and work backwards from there.

For example, Wendy’s restaurants does a great job online, but they are also a worldwide enterprise with thousands of employees and immense budgets. Not every industry or company has that luxury, so I weigh that in my ranking.

I also prefer to keep a scale simple in order to force myself to make clear judgments to avoid giving each company a 6 or 7 or 8 on the commonly-used scale of 0-10. Instead, I rank them this way:

- 0: No presence

- 1: Poor—Fix immediately or just eliminate their channel presence

- 2: Fair—Channel is used, but has a clear need for improvement

- 3: Good—Show up well, but could use refinement

- 4: Excellent—No need for improvement at this time. Should focus on improving elsewhere.

A sample chart of the scoring system above

Once you have those numbers, you can easily create charts that show how you compare against your competitors online. When you pair the ranking charts with an overall synthesis and each competitor’s highs and lows, you are all set to go.

Knowing Is Half the Battle

A Share of Voice audit can help illuminate how you are positioned online against your competitors, and it can unearth some previously unrealized online competitors. The audit helps you understand where your company stands online and is key to creating a roadmap to improve your SEO. At the end of the audit, you’ll not only have a clear picture of what you do well and what you don’t, you’ll know how you stack up against your competitors. And that’s the first step to getting better.